|

|||||||||||||||||

|

|

|

|||

|

A New View Of U.S.

Legacy Airlines Chronic Struggles By Philippe Louis |

||||

|

July 14, 2011 - Here we will to analyze the chronic

struggles of U.S. legacy carriers. We will see how

playing on many fields led to the U.S legacy carriers to

run contradictory and antagonist strategies and to

eventually an unstable financial situation.

The U.S Majors On The Domestic Market - On one hand we

have the business travelers who incited the U.S. FNSC to

establish hub at airports that are the nearest to the

central business districts to attract them: New York- La

Guardia, Miami Intl’ Airport, etc.

Additionally by the past and before open skies agreements, only 1 or 2 airports in a metro area were allowed to handle long haul and intercontinental traffic. Also, carriers must establish base in bigger airports with greater expansion potential. |

|||

|

They have

to concentrate their operations in airports that can offer

connections to international travelers. They look to concentrate

their activities in few points to obtain economy of scale. As a

consequence, for all these reasons they must set up base in

airports which fit those criterions and which are eventually the

ones with the highest fees: Washington Dulles, New York

LaGuardia, New York JFK, etc. Airports operators of the main

U.S. airports aware of all the conveniences they offer charge a

higher fee to carriers

On the

other hand, the U.S. FNSC must challenge the low cost expansion

because their market shares are rising increasingly (30% now,

from 9 % 10 years ago). They must protect their domestic market

because the domestic market represents a larger portion their

total operations (ex: 70% for United Airlines).

The

low-cost image is well established in the traveler’s perception;

substitution is easy from legacy carriers. However the low costs

presence is in different fields: less expensive airports (Fort

Lauderdale, Long Island Mc Arthur, etc.).

The legacy carriers cannot move massively their domestic activities for the reasons cited above. They have to match their domestic fares to the low costs fare levels as far as possible to retain the travelers while enduring higher costs in major airports where they have to maintain their presence, also for the reasons cited above. The U.S Majors On The International Market - The U.S. legacy carriers cannot lower too much their class services because they face foreign legacy carriers on intercontinental markets: Air France, All Nippon Airways, Qantas, Singapore Airlines, Lufthansa, British Airways, etc. U.S. carriers currently provide less than 50% of traffic on the U.S-transpacific and U.S-transatlantic routes where foreign carriers offer more flights and more seats. |

||||

|

These foreign

carriers are well quoted for their class services. International market

is where the U.S carriers do better. Consequently they must look to stay

in the race in terms of class services by fear to underperform.

But the problem is that you cannot have a class service strategy at the international and neglect the service quality on the domestic field. You can’t have 2 images in one company. The customer who flies London-New York, also flies New York-Jacksonville. The traveler compares U.S carriers to foreign ones on both domestic and intercontinental routes.

As a consequence,

the U.S. FSNCs must maintain a certain service level for both

intercontinental and domestic services while the low cost carriers do

not have to. Again that leads them to bear supplemental costs than the

budget carriers don’t have while they have to match the low cost fares.

You can’t have a Southwest Airlines and a Singapore Airlines image in

the same company.

This is how the

U.S legacy carriers end up running contradictory strategies which

increase their costs while bringing their revenues down.

Why The Foreign

Legacy Did Better - The low cost model penetrated Europe and Asia far

later than the USA. Asian and European FSNCs have a higher proportion of

long haul activity than U.S. ones. They have one or no credible national

competitor contrary to what happens in the USA. They were more protected

by the state since they had no substitute as national symbol in air

transport.

The states were

shareholders and are still shareholders in many cases (Singapore

Airlines, Air France, etc.). They

profited from favorable national legislations, and the access to the

most advantageous markets was virtually protected (Paris, London). Owing

to the geographic size of the USA (very large), legacy focus on domestic

where the competition is huge and faced the low cost.

The USA has always

had a policy against monopolies even in the air. They always had a

policy to favor small companies against bigger ones, even if those large

companies are national symbols (ex: PanAm).

Moreover, owing to

the smaller geographic size of many European and Asian countries,

foreign legacy carriers focus more on the international travel, where

they face little competition and where it’s more difficult to build a

reliable and large carrier. Contrary to the USA, in highly centralized

state it’s difficult to build a strong and large international network

outside certain cities: Paris (France), London (UK), Singapore

(Singapore), Tokyo (Japan), Amsterdam (Netherlands), Kuala Lumpur

(Malaysia), Bangkok (Thailand), etc.

There are few

substitute points from which to build a sizeable international network.

However, in the USA, you can have a substantial international network

from Miami, Dallas and Houston to Latin America; from Chicago, New York

to Europe and Asia; from Los Angeles and San Francisco to Asia Pacific,

etc. Even history plays a role in this difference. The USA was

historically a decentralized nation while the great majority of

countries on earth, including European ones have always been highly

centralized nations.

The Network

Configuration Difference Between U.S And Eurasian Carriers - U.S. legacy

carriers have a have high labor cost oriented network: USA, Canada, and

Europe. Domestic operations account for 70 % of activities in some

airlines. In times of

moderate fuel price, labor represents the biggest share of airlines

operating expenses. U.S airlines are highly active in world’s region

with high labor costs and strong union tradition: USA, Canada and

Europe. European and Asian carriers have a less geographically concentrate operating model. They are more equally present on the 6 continents. Air France, British Airways, Lufthansa and Emirates have stronger presence in Africa, the Middle East and Asia-Pacific than the U.S majors. Moreover, those world’s regions have significantly lower salaries than in North America and Europe. This gave these airlines important edge on U.S carriers on reaching good financial performances. GDP Real Growth During The 2008–2009 Financial Crisis

World map showing

real GDP growth rates for 2009. (Countries in brown are in recession.)

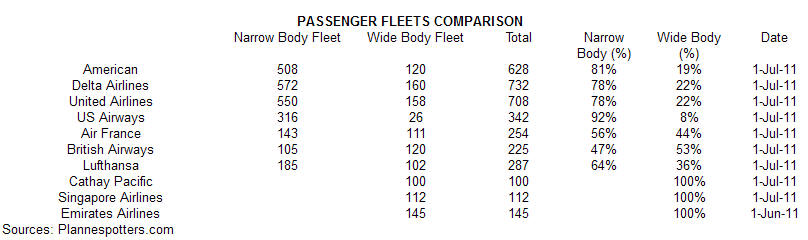

● European legacy

airlines have an international and intercontinental-oriented operating

structure while the U.S carriers have a domestic and short/medium

haul-oriented operating system. The consequences of that is that

European and Asian carriers have a larger proportion of wide-body

aircraft in their fleet. We all know the economic advantage of using

wide-body aircraft. They enable

to lower seat costs at almost all levels.

● The geographic location also play a major role. We know that the world can be divided into Western Hemisphere (Americas) and Eastern Hemisphere (Europe, Asia, Africa, and Oceania). European and Asian carriers can at a greater extent use their hub as world transit point for international and intercontinental passengers. American carriers cannot easily do the same as they are disadvantaged geographically.

London, Paris and

Frankfurt are well known for being important traffic transit hubs

between North America/Europe to Asia/Africa. Emirates Airline is now

trying aggressively to get a piece of that huge and lucrative market.

This is the reason why the airline is amazingly big despite the tiny

size of the country’s population, land area and GDP.

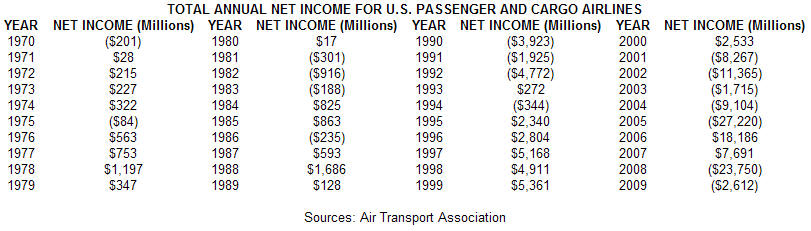

● European and Asian airlines are also more resilient to industry shocks than U.S. carriers. Being on the Eastern Hemisphere and having their network more evenly spread across the globe make these airlines more resistant to shocks. We all know in the industry that any variation of the demand has a great impact on the profit of airlines. The U.S market is huge but U.S carriers don’t have a credible counterbalance to the variation of the demand for that market. Its size is too big comparing to the U.S international and U.S intercontinental markets. On the contrary European and Asian carriers have a more balanced advanced economies/emerging countries presence. It’s not surprising to see many airlines posting annual passengers and profit growths during industry meltdowns (Singapore Airlines during the SRAS crisis in 2003 and in the financial crisis in 2008, Emirates in 2008 and 2009).

The air transport

cycle is follows to the economy’s cycle. When you have 70% of your

activity affected to a world’s region (USA), it’s difficult to find a

counterbalance when this region is hit economically. Moreover, Europe is

the foreign continent where U.S airlines have the largest presence.

However, the European economy is strongly correlated to the U.S one.

This doesn’t make things easier for U.S airlines at all. As example, out

of their 260 destinations, American Airlines only flies 13 destinations

in Europe, 0 in Africa, 0 in the Middle East, 0 in Oceania and 5 in

Asia-Pacific (excl. Oceania).

|

|

|

| ©AvStop

Online Magazine

Contact

Us

Return To News

|

|